Disclaimer: I am by no means a financial expert. Please seek financial advice from a fiduciary.

The largest source of greenhouse gas emissions come from fossil fuels. Divesting means taking your money out of institutions that fund fossil fuels and fossil fuel expansion, which weakens those fossil fuel projects and companies both financially and reputationally. The fossil fuel divestment movement has removed over $11 trillion dollars from oil, coal and gas companies who are fueling the climate crisis.

As Bill McKibben wrote in The Guardian: “The deeper question, though, is whether divestment is making a dent in the fossil fuel industry. And there the answer is even clearer: this has become the deepest challenge yet to the companies that have kept us on the path to climate destruction.

“At first we thought our biggest effect would be to rob fossil fuel companies of their social licence. Since their political lobbying power is above all what prevents governments taking serious action on global warming, that would have been worth the fight. And indeed academic research makes it clear that’s happened – one study concluded that “liberal policy ideas (such as a carbon tax), which had previously been marginalised in the US debate, gained increased attention and legitimacy”. That makes sense: most people don’t have a coal mine or gas pipeline in their backyard, but everyone has – through their alma mater, their church, their local government – some connection to a large pot of money.

“As time went on, though, it became clear that divestment was also squeezing the industry. Peabody, the world’s biggest coal company, announced plans for bankruptcy in 2016; on the list of reasons for its problems, it counted the divestment movement, which was making it hard to raise capital. Indeed, just a few weeks ago analysts at that radical collective Goldman Sachs said the “divestment movement has been a key driver of the coal sector’s 60% de-rating over the past five years”.

“Now the contagion seems to be spreading to the oil and gas sector, where Shell announced earlier this year that divestment should be considered a “material risk” to its business. That’s how oil companies across the world are treating it – in the US, petroleum producers have set up a website designed to discredit divestment,.

“Divestment by itself is not going to win the climate fight. But by weakening – reputationally and financially – those players that are determined to stick to business as usual, it’s one crucial part of a broader strategy.”

Fossil Free VSC

From February 2017 to summer 2018, Castleton University Associate Professor Brendan Lalor and I facilitated a Fossil Free VSC group, an alliance of students, alumni, faculty, staff and residents of the broader Vermont State Colleges community (where we both work). Fossil Free VSC worked with the VSCS Board of Trustees and the Facility & Finance Committee to shift 20% of the VSCS’ endowment to fossil-free investments, and provide fossil-free retirement options for all VSCS employees.

My Divestment and Reinvestment

As a Vermont State Colleges System employee, my fledgling retirement portfolio, which my employer began contributing to in 2016, had — by default — contributions invested 100% in TIAA-CREF Lifecycle 2050-Institutional (TFTIX).

Now, I had to do a bit of research. I had found an excellent online resource, https://fossilfreefunds.org that allows anyone to type in the name or ticker symbol of a fund and see if any of the underlying companies of the fund were associated with fossil fuels. Fossil Free Funds analyzes the climate impact of thousands of U.S. mutual funds and ETFs and shows you if your money is being invested in fossil fuel companies, or companies with high carbon footprints. I tried typing in TFTIX into fossilfreefunds.org, but it didn’t come up with any results. I went back to my TIAA quarterly statements, and learned that since TIAA-CREF Lifecycle 2050-Institutional (TFTIX) is a multi-asset investment, comprised of multiple holdings, I needed to figure out what those holdings were. Then, I could search those holdings on fossilfreefunds.org Sites like Yahoo! Finance are able to breakdown multi-asset investments into the constituent holdings. For TFTIX, these included (but weren’t limited to) these funds: TIAA-CREF Growth & Income (TGIWX), TIAA-CREF Large-Cap Growth (TILWX), TIAA-CREF Large-Cap Value (TRLWX), TIAA-CREF Quant Large-Cap Growth (TECWX) and TIAA-CREF Quant Large-Cap Value (TELWX).

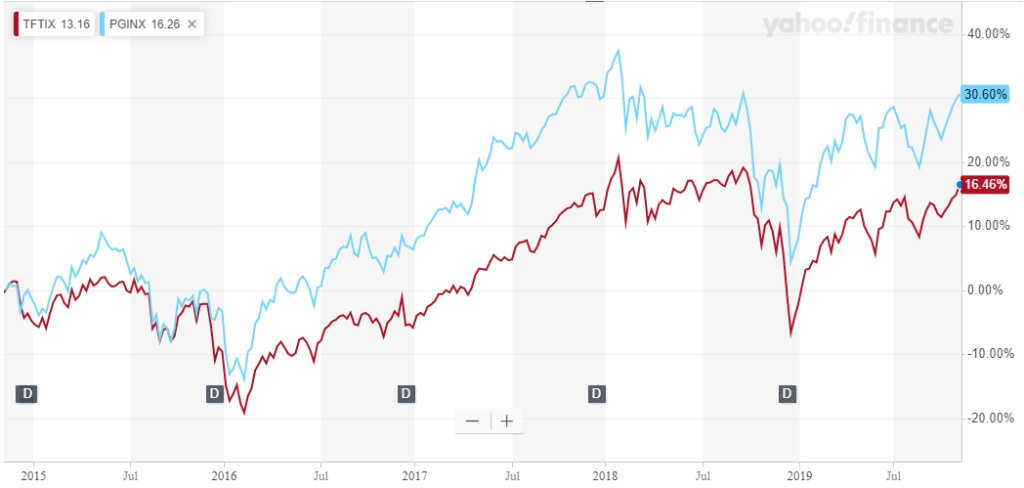

A quick search on fossilfreefunds.org with these ticker symbols showed that a lot of those funds contained companies that are associated with fossil fuels. Not only was I concerned about the financial ramifications associated with investing in fossil fuel companies (e.g. financial losses), for me it was also an ethical choice. I didn’t want to support, with my own money (small as it is), companies that are robbing life from humans, other species, and ecosystems. I wanted to invest in my values. With the no-carbon Pax Global Environmental Markets Fund (PGINX) now offered through my TIAA account, it was a no-brainer for me to move 100% of my existing retirement portfolio, as well as allocate 100% of all future contributions, to PGINX.

Source: https://finance.yahoo.com/

Most financial advisors agree that 10–20% of your salary is a good amount to contribute toward retirement. Several advise on at least 15%. I knew my employer’s contribution to my retirement account was less than 15%. Check back next week for how I decided to compensate for this!

In the meantime, you can build a fossil-free portfolio by finding socially-responsible investing financial advisors on GreenPages.org and by encouraging your faith organization or alma mater to divest from fossil fuels (and re-invest in environmentally sustainable investments).

Leave a Reply