Last week, I shared how I divested my retirement account that I hold through my employer of fossil fuel companies, and re-invested in a fossil-fuel-free mutual fund. Most financial advisors agree that 10–20% of your salary is a good amount to contribute toward retirement. Several advise on at least 15%. In 2017 when I realized my employer’s contribution to my retirement account was less than 15% of my salary, I decided to supplement employer-sponsored retirement by also investing in the stock market. Here is where I add the disclaimer that I am by no means a financial expert. Please consult a certified fiduciary for your own finances.

I did a bunch of research, including reading, including “The Index Card: Why Personal Finance Doesn’t Have to Be Complicated” by Helaine Olen and Harold Pollack. I also watched many YouTube videos about personal finance and investing. This was also around the time that a friend posted on Facebook about how quick and easy it was to get their feet wet in the stock market with a new smartphone app called Robinhood. It seemed too good to be true — it was (and still is) possible to use Robinhood essentially for free (i.e. no commissions/fees), and I could dabble into investing with a very small amount of money.

Then, I came across a financial security called an Exchange Traded Fund, or ETF for short. ETFs are sort of like a hybrid between mutual funds (groups of stocks, bonds, etc.) and individual stocks. ETFs are listed on exchanges and ETF shares trade throughout the day just like ordinary stock. “The Index Card” book suggested NOT holding individual stocks, but instead having a portion of holdings in an S&P Index Fund, another portion in small-cap (market capitalization between $300 million and $2 billion) funds, and another portion in international funds. The book also suggested holding some assets in bonds. The neat thing about Robinhood is that one can have ETFs in your portfolio, and some bonds are even available as ETFs.

I used fossilfreefunds.org to screen which ETFs did NOT have fossil fuel stock holdings (i.e. earning 5 badges on their website). I also looked at ETFs that scored an A or B for Deforestation stock holdings, specifically avoiding companies that use palm oil.

The problem with palm oil

Palm oil is used in everything from cosmetics to food to soap. There is enormous demand for it. But it is hugely controversial because it involves the clearing of tropical rainforests to grow palm oil plantations. This has led to the loss of biodiversity and habitat for under-threat animals such as the orangutan. Greenpeace International recently reported about the fires blazing in Indonesia, that have placed nearly 10 million children at risk, are linked to companies widely considered to be “sustainability leaders” in palm oil. The fires and their smokey haze are causing health problems for people in Indonesia, Singapore, Malaysia, and the Philippines. They are also driving the climate catastrophe. This year alone, the fires in Indonesia have already emitted almost as much CO2 as the entire United Kingdom does in one year. Greenpeace International’s research found that Unilever, Mondelez, Nestle, and P&G are each linked to nearly 10,000 fire hotspots in 2019 alone. Despite Indonesia’s freeze on palm oil plantation permits, the process lacks transparency, making it difficult to assess its effectiveness, and the government should provide updated information, an industry watchdog official recently told Reuters.

The Excel file

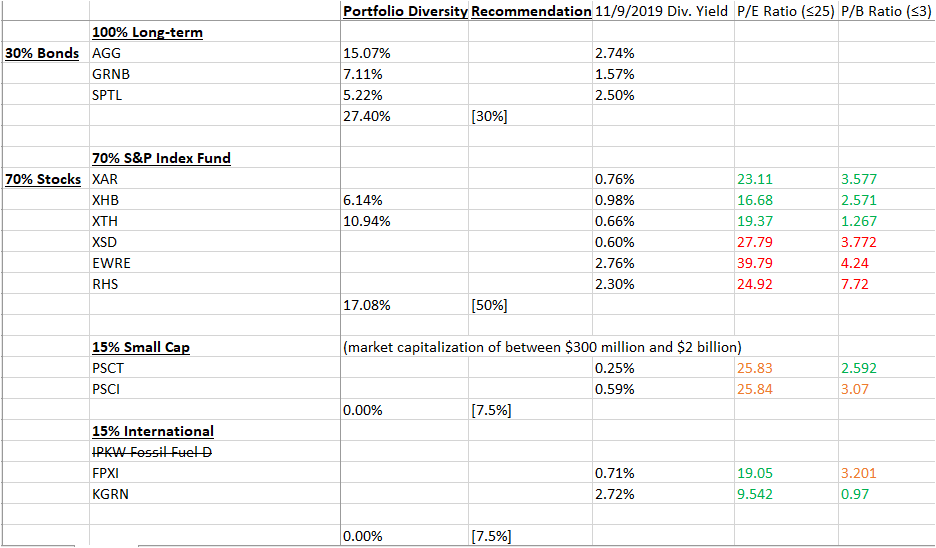

In practice, quarterly, I contribute the approximate difference in percentage between what my employer contributes to my retirement account, and 15% of my salary. This allows me to gradually build a portfolio of stocks and bonds, which happen to both be ETFs. I have a group of “watchlist” ETFs that are waiting in the wings. These are ETFs that I might be interested in buying but don’t currently have enough money (because I only add additional, fixed, buying power quarterly), and/or are not favorable to buy (I use a rough rule of thumb to determine a favorable buying price: the P/E ratio should be less than or equal to 25, and the P/B ratio should be less than or equal to 3.) I then keep track of these values over time, and color code them on an Excel spreadsheet. The “recommendation” column is the advised percentage from “The Notecard” book.

You’ll notice IPKW is crossed out. This is because I realized earlier this month that fossilfreefunds.org gives it a D rating for fossil fuels. So, I divested from that fund, and reinvested in other (fossil-fuel-free) funds. The other neat thing about fossilfreefunds.org is that it shows you what percentage of your mutual fund or ETF is invested in the Clean200, “a list of 200 publicly traded companies that are leading the way with solutions for the transition to clean energy.” This makes me feel good about investing in the companies that share my values, while simultaneously NOT investing in companies that do not share my values. It’s entirely possible to do both!

If you have mutual funds and/or stocks, I highly encourage you to talk to a certified fiduciary about screening your portfolio for fossil fuel companies, divesting of those companies, and re-investing in the Clean200 companies. To learn more about investing in your values, visit https://www.asyousow.org/invest-your-values/

Leave a Reply